We will collaborate to build this glossary of term to help us extend our vocabulary for this course. We need to include key terms which are unfamiliar and will be good to know for the upcoming exam in January.

Special | A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | ALL

B |

|---|

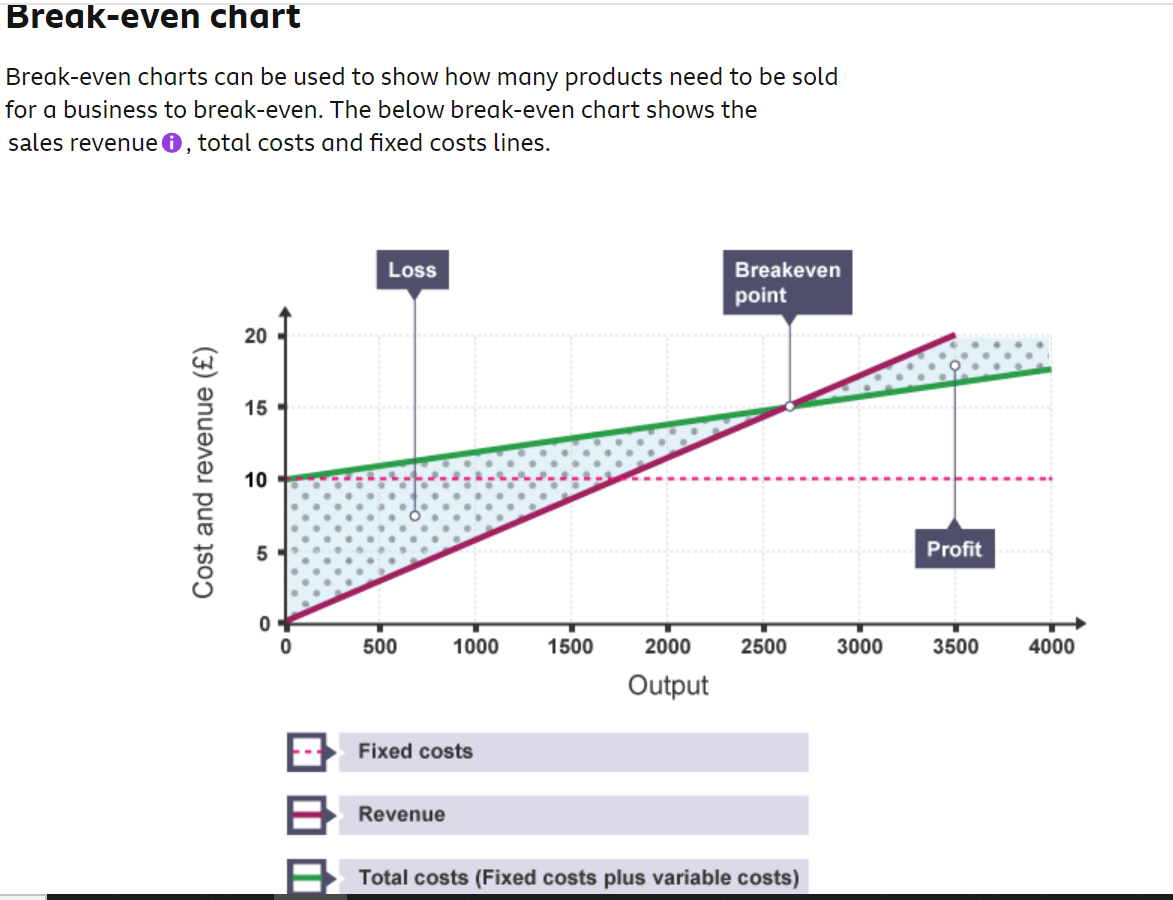

Break even chart example

| |

Break Even Chart ExplainerSelect the link below to access an explainer video | |

C |

|---|

Capital ExpenditureCapital expenditure are funds used to

acquire or upgrade physical assets such as property, buildings or equipment and

also intangibles | ||

Capital incomeIncome that comes from the investors/owners of a business. This income is typically used to buy assets for the company like property or equipment. Sources of capital income include:

| ||

contribution per unit | |

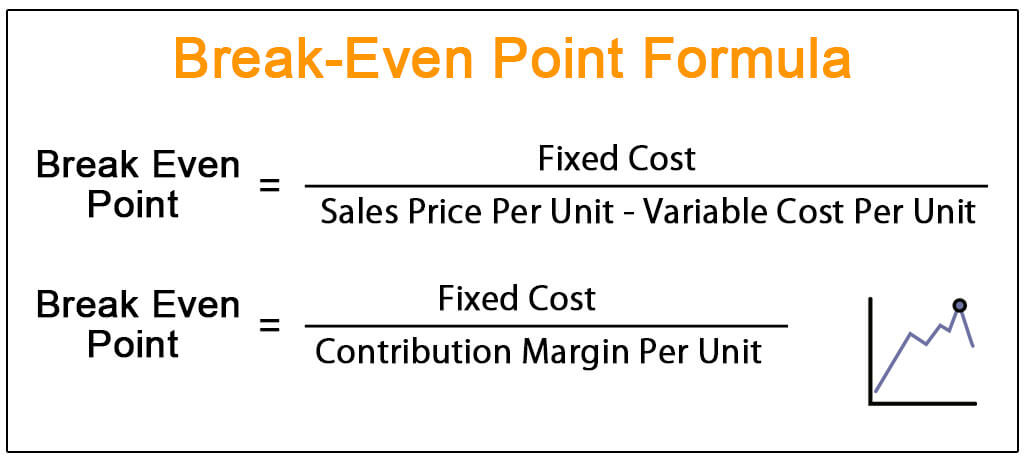

Contribution per unit (example)The amount of contribution selling one unit will make towards breaking even. Calculated as Selling price - Variable cost per unit. E.g. If you are selling each unit for £10, and they each cost £4 to make, you would do £10-£4=£6. This means that the contribution per unit is £6. Contribution per unit is also used to calculate the break even point | |

Current Ratio | |

D |

|---|

Debt FactoringDebt factoring involves a business selling their invoices to a third party at a discounted price in order to bypass the hefty waiting times which are associated with invoice payments. This means they receive the money they are owed quickly however it comes at a cost as the get a discounted amount from the debt factoring company. | |

DepreciationSelect the link below for an explainer about 'Depreciation' | |